登录网上银行

个人银行

商业银行

登录网上银行

个人银行

商业银行

登录网上银行

商业银行

查询最新汇率,请致电 626-279-3235 联系外汇部。

March 4, 2026

Service sector activity in the U.S. grew at a faster pace in February. The services purchasing managers index (PMI) increased to 56.1 in February, up from 53.8 in January. A reading above 50 indicates growth, marking the highest level for the services PMI since it reached 56.5 in July 2022.

The rise in the PMI was fueled by a significant increase in new orders, with the new orders index jumping to 58.6 in February from 53.1 in January. Additionally, the business activity index rose to 59.9 in February from 57.4 in January, while the employment index increased to 51.8 in February, up from 50.3 in January.

The prices index decreased to 63.0 in February, down from 66.6 in January, reaching its lowest level since March 2025, when it was 61.4. Meanwhile, manufacturing activity saw a slight slowdown, with the manufacturing PMI edging down to 52.4 in February from 52.6 in January, but a reading above 50 still indicates growth. 03/04/2026 - 10:33:00 (RTTNews)

The private sector employment in the U.S. increased in February, adding 63,000 jobs in February after rising by 11,000 jobs in January.

Private sector employment experienced its largest increase since July 2025, adding 104,000 jobs. This growth was primarily driven by the construction sector and the education and health services sector, which contributed 58,000 and 19,000 jobs, respectively. However, the professional and business services sector saw a decline, losing 30,000 jobs, while the manufacturing sector experienced a reduction of 5,000 jobs.

As hiring has been concentrated in just a few sectors, there has been no widespread pay increase associated with changing jobs. In fact, the pay premium for switching employers reached a record low in February. Pay growth for employees who stayed in their positions remained stable at 4.5% year-over-year in February, while annual pay growth for job changers slowed to 6.3%. (03/04/2026 - 09:48:00, RTTNews)

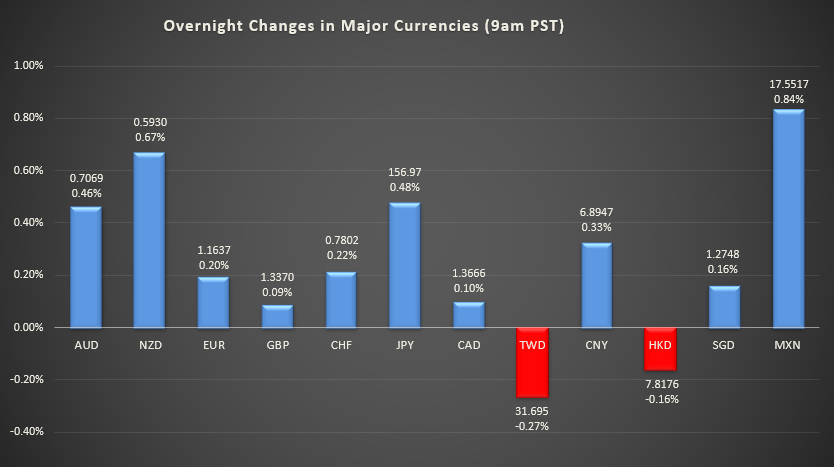

Euro traded at 1.1637 against USD at 9:00 AM PST

In February, private sector growth in the Eurozone improved due to a quicker rise in demand for goods and services. The services Purchasing Manager Index (PMI) rose to 51.9, up from 51.6 in January.

Among the four largest economies, business activity growth was observed in all except France, which experienced near stagnation in February. Germany emerged as the growth leader in the early stages of the quarter, achieving its fastest growth in four months. Italy also saw solid expansion, while Spain reported its slowest increase in business activity since May of the previous year.

Germany's private sector growth accelerated in February, driven by faster increases in both the manufacturing and services sectors. The services PMI climbed to 53.5 in February, up from 52.4 in January, marking the highest score since last October.

France's private sector output stagnated in February, with the services Purchasing Managers' Index (PMI) dropping to 49.6, down from 48.4 in the previous month. In contrast, Italy's private sector experienced growth in February, boosted by an increase in both manufacturing and services. However, the services PMI declined to 52.3 in February from 52.9 in January. Meanwhile, Spain's private sector grew at the slowest rate since May 2025, with the services PMI falling to 51.9 in February, down from 53.5 the month before.

The eurozone unemployment rate dropped slightly in January. The jobless rate fell to seasonally adjusted 6.1% from 6.2% in December. The number of unemployed people decreased by 184,000 from December. Compared to last year, unemployment fell 273,000 to 10.77 million.

As of January, there were 2.352 million young people without jobs, down by 27,000 from December. The youth unemployment rate decreased to 14.8% from 15.0% in December. The unemployment rate in EU27 came in at 5.8% compared to 5.9% in December. 03/04/2026 - 05:59:00 (RTTNews)

国泰银行准备的此市场最新讯息仅供参考,不构成任何形式的法律、税务或投资建议,也不应被视为对未来汇率变动或趋势的保证或担保。提供此信息时没有考虑任何接收者的特定目标、财务状况或需求。国泰银行对本市场最新讯息的准确性、完整性或充分性不做任何表述或保证。