March 12, 2026

United States

The U.S. trade deficit narrowed in January. The trade deficit decreased to $54.5 billion in January, down from $72.9 billion in December. The trade deficit decreased to $67.9 billion from the $70.3 billion originally reported for the previous month. The narrower trade deficit came as the value of exports spiked by 5.5% to $302.1 billion in January after slumping by 1.6% to $286.3 billion in December.

Exports of industrial supplies and materials led the rebound amid sharp increases in exports of non-monetary gold and other precious metals. Exports of capital goods like computers and civilian aircraft increased, while exports of pharmaceuticals decreased.

Meanwhile, the value of imports slid by 0.7% to $356.6 billion in January after surging by 3.5% to $359.2 billion in December. Imports of pharmaceuticals and automotive vehicles, parts, and engines slumped during the month, while imports of computers saw a notable increase.

The goods deficit narrowed to $81.8 billion in January from $99.2 billion in December, while the services surplus widened to $27.3 billion in January from $26.3 billion in December. 03/12/2026 - 10:06:00 (RTTNews)

First-time claims for U.S. unemployment benefits edged slightly lower in the week ending on March 7, according to a report released by the Labor Department on Thursday. The Labor Department said initial jobless claims slipped to 213,000, a decrease of 1,000 from the previous week's 214,000.

The less volatile four-week moving average also dipped to 212,000, a decrease of 4,000 from the previous average of 216,000. Continuing claims, a reading on the number of people receiving ongoing unemployment assistance, also fell by 21,000 to 1.850 million in the week ending on February 28. The four-week moving average of continuing claims edged down to 1,851,750, a decrease of 500 from the previous week's average of 1,852,250.

Last Friday, the Labor Department released a more closely watched report showing employment in the U.S. unexpectedly decreased in the month of February. The report said non-farm payroll employment slumped by 92,000 jobs in February after jumping by 126,000 jobs in January. The Labor Department also said the unemployment rate ticked up to 4.4% in February from 4.3% in January. 03/12/2026 - 09:54:00 (RTTNews)

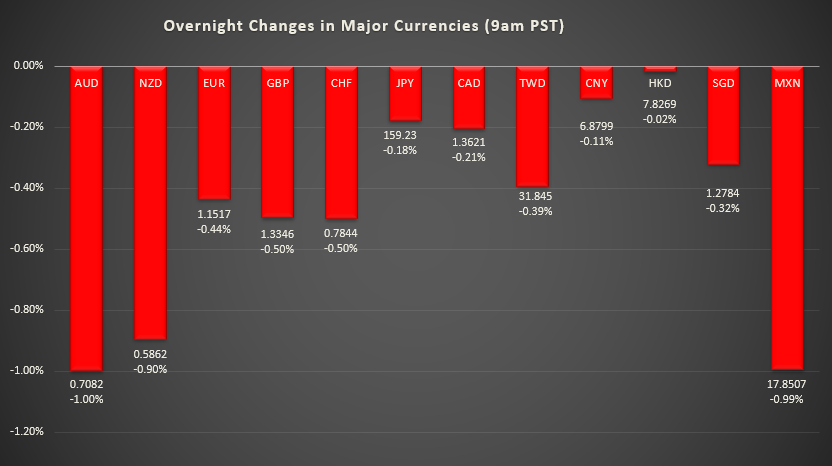

Australian Dollar Falls as Risk-off Sentiment Increases on Middle East War

The Australian dollar weakened against other major currencies in the Asian session on Thursday amid increasing risk-off sentiment by the investors, as the joint U.S.-Israeli strikes against Iran continue unabated, leading to a fresh surge in crude oil prices that reinforced global inflationary concerns.

In the Asian trading today, the Australian dollar fell to a 2-day low of 0.7111 against the U.S. dollar, from yesterday's closing value of 0.7152. Against the yen and the euro, the Australian dollar slipped to 113.12 and 1.6236 from Wednesday's closing quotes of 113.68 and 1.6173. Against the Canadian and the New Zealand dollars, the Australian dollar slid to 0.9665 and 1.2060 from yesterday's closing quotes of 0.9722 and 1.2095. 03/12/2026 - 04:15:00 (RTTNews)